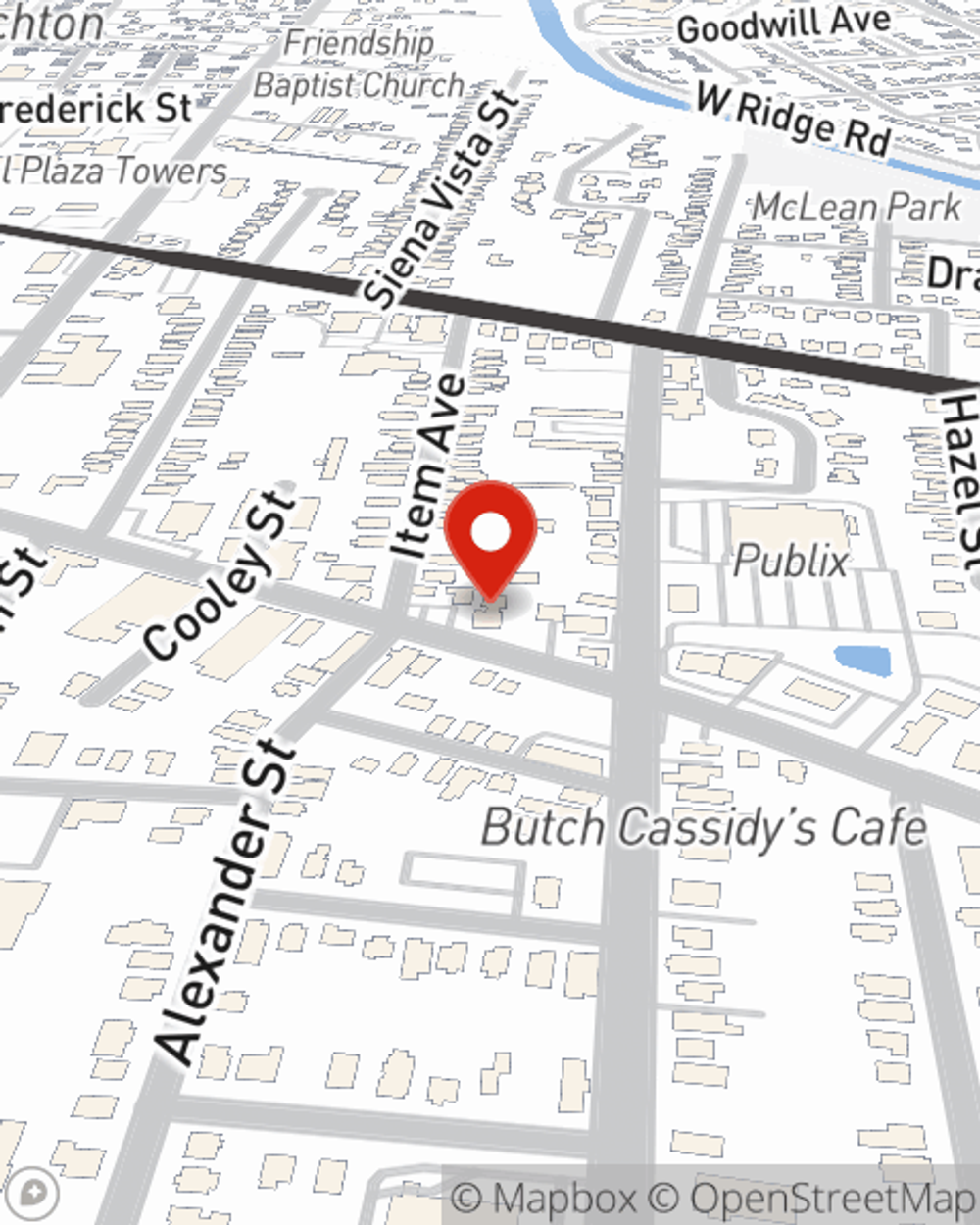

Life Insurance in and around Mobile

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

When you're young and just starting out in life, you may think Life insurance is only for when you get old. But it's a great time to start talking about Life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Mobile Chooses Life Insurance From State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Makeda Nichols can help you with a policy that works for you.

If you're a person, life insurance is for you. Agent Makeda Nichols would love to help you check out the variety of coverage options that State Farm offers and help you get a policy that's right for you and your children. Contact Makeda Nichols's office to get started.

Have More Questions About Life Insurance?

Call Makeda at (251) 471-1108 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Makeda Nichols

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.